In a world where most major purchases – such as buying a house or a car – cannot be done with cash, the practical constraint to the question “how much can I afford to buy?” is usually based on “what monthly debt payment can I afford to make?” As a result, lender thresholds for the maximum amount to borrow – such as the popular 28/36 debt-to-income-ratios – are typically used to determine affordability.

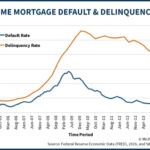

However, the reality is that what’s good for the lender may not necessarily be good for the borrower. After all, lenders lend money assuming that at least some people will default, and that the rest will do ‘whatever it takes’ to repay the loan, even if that means significantly curtailing lifestyle. In other words, lending guidelines are based not on fiscal prudence, but the maximum amount of pain the borrower is anticipated to tolerate without causing mass defaults!

In turn, this suggests that when evaluating how much a borrower can really “afford”, without potentially making themselves miserable, lender guidelines should not be relied upon. Or at least, it suggests that consumers need a #FinTech tool for themselves, that can evaluate the financial risk of their borrowing, but based on prudent borrowing that minimizes the risk of default, rather than maximizing the level of “acceptable” default loss for the lender!

Of course, ideally the determination of spending levels shouldn’t be based on what you can afford (by borrowing against the future!) in the first place, but what is “enough” to bring about a comfortable lifestyle. Though in a world of trying to “keep up with the Joneses”, that is clearly easier said than done!